Suitable for cashflow

Are there any lenders taking bad credit businesses with guaranteed approval in Australia?

There are a lot of bad credit businesses in Australia which desperately need a quick injection to their cashflow. Banks are irrelevant for them now, or perhaps have been irrelevant for a long time, and these business owners are looking for an unsecured business loan from a private lender.

This is not a requirement which is specific to any particular industry or region in Australia. If you look at our business loan industry research you will see that many of the businesses who use the Become financing platform (a loan matching platform for quick lending) come from a variety of industries, are businesses of all size, and have unique financing requirements.

Bad credit business lending blossoms in Australia

There is a very large selection of online lenders in Australia which can be applicable for small businesses with a less-than-perfect business credit score! None of them offers a “guaranteed approval” loan, simply because that’s not how it works in real life, but relatively they are more receptive to bad credit scores, especially in comparison with banks.

$25,000 to $200,000

1 month to 1 year

- Flexible loan solution

- Interest rate discount

- Choice of repayment frequency

- Fast funding

- No hidden fees

$2,000 up to $500,000

from 1 month to 2 years

- Consolidate debts

- Simple Online Application

- Loan amounts to suit any need

- Flexible repayment terms

- Tailored loan solution

- No security required

- Overnight funding

$5,000 to $600,000

3 months to 3 years

- Straightforward application process

- Unsecured loan

- Flexible repayments

- Quick approval process

- Interest on owed amount only

- Pay back at your own pace

-

$20,000 – $5,000,000

Up to 25 years

- Large borrowing rate

- Fixed or variable rate options

- Personalised support

- Varied loan terms

- No account fees

- Frequent payments

- Redraw option

- Internet banking

- Startup businesses can apply

Max. Loan Amount $300,000

3 months to 2 years

- No assets as security

- Negotiable loan term

- Convenient loan repayments

- Fast approval process

- No hidden fees

$5,000 up to $100,000

Secured and Unsecured Business Loans

- Funding: $5,000 up to $100,000.

- Recipient of multiple industry awards

- Funding granted within 48h

- 4.9 / 5 rating on TrustPilot

- 20,000+ Australian Businesses Funded to date

- ASX Traded Company

- Clear T&C and repayments

- Excellent website and onboarding

Loan-to-Value Ratio up to 90%+

Loan terms up to 30 years+

- Funds up to $100m

- Wide range of funding solutions

- Over 30 years of trading history

- Good customer reviews

- Interest Only Home Loans

- Strict credit criteria

- Slower Turn Home Loan Approvals

- Properties that are unique

- People with bad credit

Minimum of $10,000

Flexible repayment options

- Fast access to funds

- Flexible to your needs

- Variable or fixed interest rate

- Flexible repayment options

$100,000 – $10,000,000

1 month to 2 years

- Funding from $100,000 to $10 million

- Fast 24 hour approval

- Secure transactions

- Earn rewards like Qantas Points

Minimum loan amount $20,000

Up to 30 years

- No physical assets required for security

- Fast access to funds

- Quick online application process

- Offer a variety of business

- No assets for security

Are there any lenders who would take on any business, regardless of its credit score with a “GUARANTEED APPROVAL”? The short answer is no.

There are no bad credit score business loans with guaranteed approval. There aren’t lenders who are in the business of financing to accept anyone off the street, and provide companies with financing regardless of whether they believe the debt will be repaid in the future.

The longer answer is that there are plenty of lenders who are happy to take on bad credit businesses, but they won’t take just “any business”. They will inspect other aspects of the business and rely heavily on the average income, while minimizing their risk and make only a small loan of approximately one month of revenue.

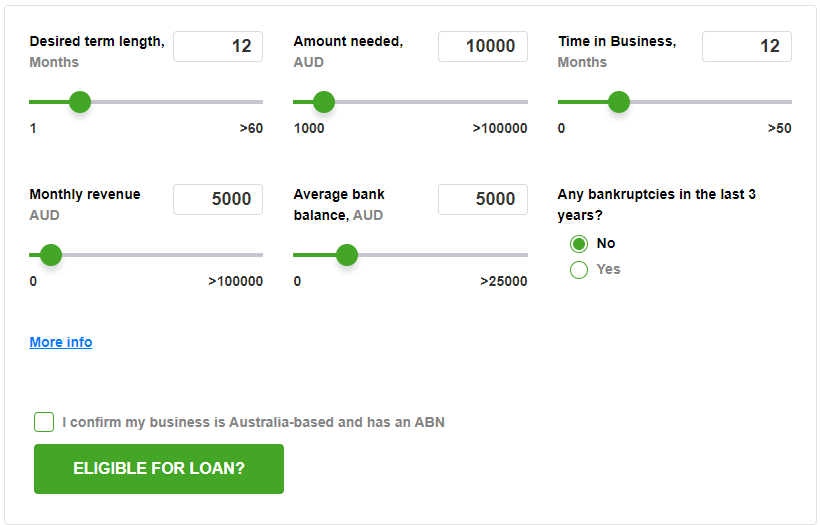

We have created a nifty calculator for you to check how likely you are to get the loan you require:

What’s the catch?

There isn’t a catch, per se, but there is a downside in comparison to bank loans or loans that would have been provided to your business if you had an immaculate credit score. It will be more expensive, and it could be really costly. This form of finance is a quick injection of cash destined to bridge over an unexpected cash gap, and it should be repaid as quickly as possible. Choosing the right lender, or using platforms that submit your quote to multiple lenders, can be another way of improving your chances of being approved as well as receiving multiple quotes to choose from.

Wait, so should I seek a bad credit business loan that will accept me?

That question is really specific to your business. We cannot legally provide any financial advice, and even the online lending providers who are more receptive to bad credit business’ would not be able to give you a definite “yes” or “no” without understanding the specific loan requirements of your business.

Here are some guidelines to follow in order to make a decision whether you should be looking for a bad credit business loan at all.

- Do you have any alternatives? Probably not, else you would not have typed “small business loans guaranteed approval” on Google.

- Are you able to repay? If you are not sure whether you can repay your loan, you should not do it.

- Are you able to repay in a reasonable period of time? As bad credit business loans levy incredibly high fees, dragging on a bad credit high interest business loan for prolonged periods will be very costly and could very well be the demise of your business.

- Do you have a specific need for the advance you’re considering? Are you actually going to improve any aspect of your business by taking this loan?

These are some of the considerations but sorry, that’s all we can provide at this point.

I discovered a lender that is willing to provide a bad credit cash advance to any business.

There are predatory lenders out there on the market who are willing to take everyone and anyone. In fact these lenders won’t even care if you are a business owner or an individual, as their main business is consumer credit, or in other words bad credit loans for individuals, the riskiest and shadiest domain within financing.

These predatory lenders generally won’t care about security or the state of your business; in fact, they would be happy if you fail to pay your business cash advance, or personal cash advance, on time. With an annualized interest rate of 3-figures or more, the more your repayment is delayed, the more they earn. They have very good collection agencies that will make sure whatever money you are able to produce will go back to them, and if your business is struggling you may end up paying them for years and years to come, without ever managing to repay the original loan amount.

The same can be said about business loan brokers in Australia – some of them make promises in vain in order to try and convince unsuspecting business owners into highly expensive personal loans.

One thing that may be an exception is an invoice financing company which places that loan against the invoices which form a way of security. Just remember to proceed with care. The same rules apply when you are looking for a bad credit business loan and you will always be sure all fees and associated costs are detailed to you at the onset of the loan. As a bad credit borrower you just have to be especially aware of this and the implications of the loan repayments in your cash flow forecasting.